Autistic Burnout: Symptoms, Causes, Recovery, and How to Heal

Autistic burnout is a debilitating state of physical and mental exhaustion, often accompanied by a significant loss of skills and a reduced tolerance for sensory input. Unlike standard professional burnout...

BPD vs Autism: Key Differences, Overlap, Misdiagnosis & How to Tell the Difference

In the modern clinical landscape, few diagnostic puzzles are as complex as the comparison between...

Nervous System Reset: How to Heal a Dysregulated Nervous System Naturally

In the modern world, our bodies are often living in a state of “perpetual amber.”...

Dorsal Vagal Shutdown: Symptoms, Causes, Duration, and How to Recover

In my clinical work at Reflection Psychological Services, I have personally understood that Dorsal Vagal...

Mental Health Conditions

Am I Bipolar?

Explore bipolar disorder basics including symptoms, types (I & II), causes, and more. Get clear, reliable info to better understand this condition and find support.

Bipolar Personality

Does bipolar disorder change your personality? Explore how bipolar affects traits, common misconceptions, and tips for managing identity alongside the condition.

Types of Bipolar

Understand the different types of bipolar disorder – Bipolar I, Bipolar II, cyclothymic, and others – with key differences in symptoms and severity explained.

Bipolar stories

Read inspiring bipolar stories from people living with the condition. Gain hope, insights, and practical tips from real-life journeys of managing bipolar.

Top Reads

Schizoaffective Disorder: Symptoms, Types, Treatment & How It Differs From Schizophrenia

Navigating the landscape of mental health can be challenging, especially…

Does Abilify Cause Weight Gain? What to Expect, Why It Happens, and How to Reduce the Risk

If you have been prescribed Abilify, you are likely navigating…

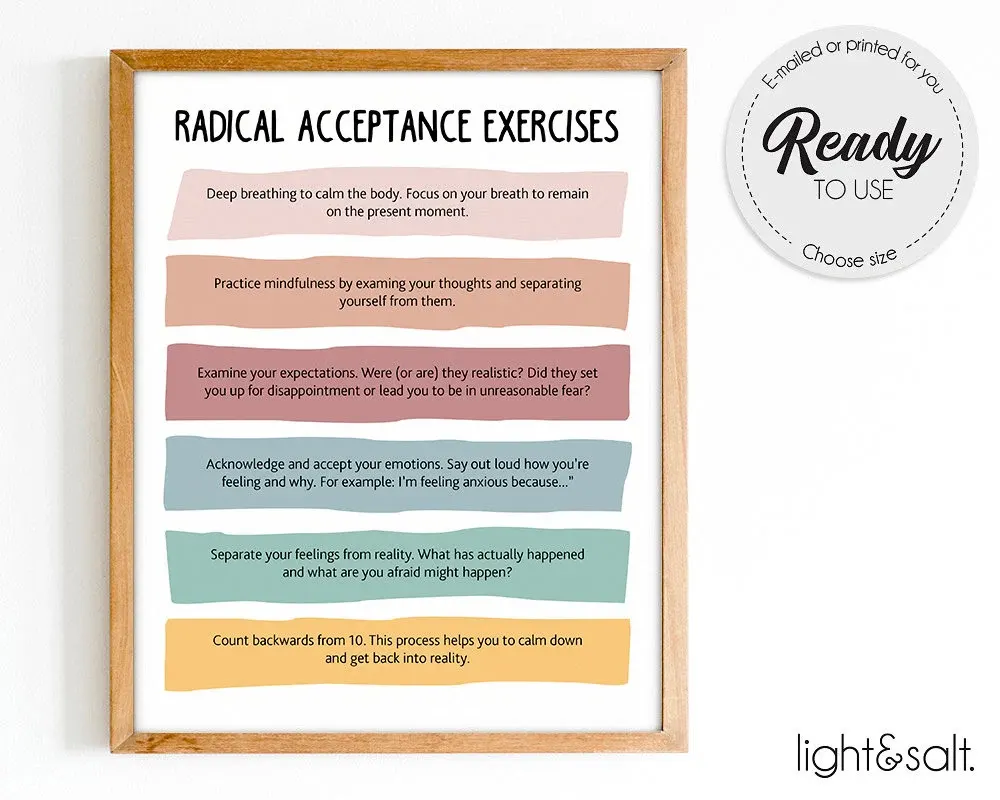

Radical Acceptance in DBT: Definition, Worksheets, Step-by-Step Practice & Real-Life Examples

In my practice, I often sit with individuals who feel…

Bipolar Disorder Medications: Most Commonly Prescribed Drugs, Treatment Options & What Works Best

Living with bipolar disorder is often described as a journey…

Subscribe to Our Newsletter

Get mental health tips, updates, and resources delivered to your inbox.

Featured Stories

Featured Mental Health Topics

Get Support

Read More

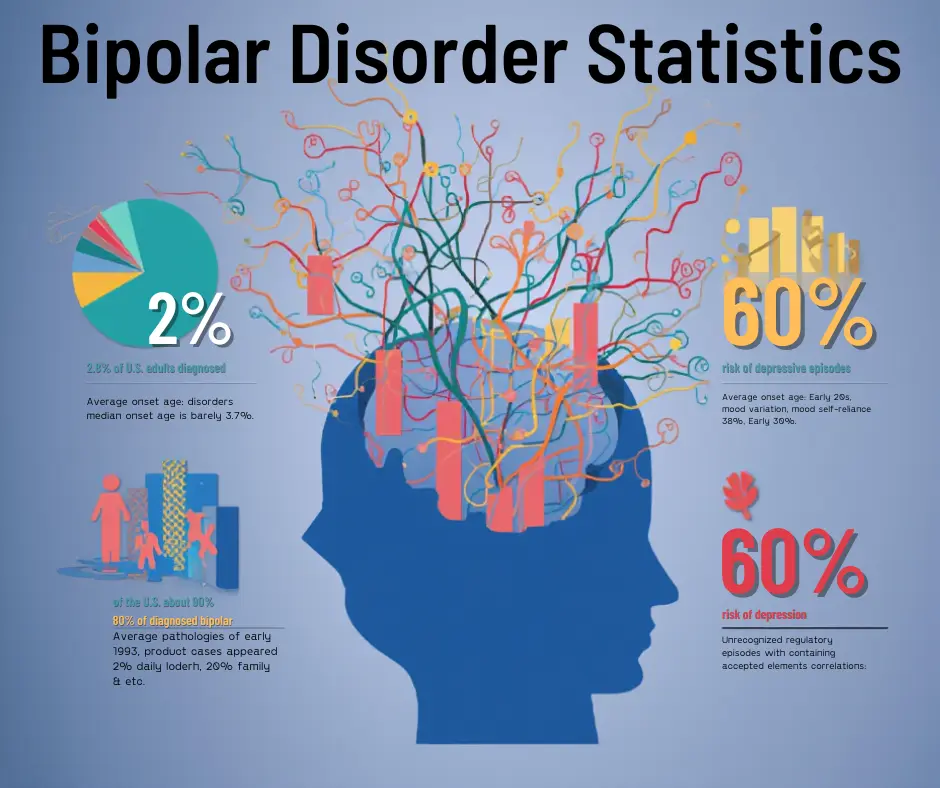

Bipolar Disorder Statistics, Facts & Treatment (2026 Guide)

Hey there. Are you looking for the truth behind the numbers? You are not alone in this search. Many people...

Emotional Intelligence: What It Is, Why It Matters, and How to Improve It

In the modern landscape of 2026, where technical skills are increasingly augmented by artificial intelligence, the human element has become...

Anxiety Medication: The Complete Guide to Options, Uses, and Alternatives

Anxiety is a natural human response—a biological alarm system designed to keep us safe from danger. However, for millions of...